Why First-Time Homebuyers Are Older Than Ever — And What It Really Means

If it feels like everyone buying their first home these days is a little older than they used to be, you’re not imagining it.

According to the 2025 Profile of Home Buyers and Sellers from the National Association of REALTORS®, the median age of first-time buyers just hit 40 — the oldest on record.

That’s up from 38 last year and a big jump from the late 20s back in the 1980s. So what changed? Why are so many people waiting longer to buy? Let’s unpack the craziness together.

Buying a Home Really Is Harder Now

The same report shows that first-time buyers only made up 21% of home purchases in 2025 — the lowest ever recorded. For decades, that number hovered closer to 40%.

What that means: fewer people are managing to buy their first home, and the ones who do are saving longer, carrying more debt, and facing tougher competition than any previous generation.

The Market Is Divided — and Repeat Buyers Have the Upper Hand

While first-time buyers are struggling to get in, repeat buyers are taking over. These are folks who already own a home, are selling, and moving up — and they’ve got the advantage.

Here’s what the data shows:

-

The median age of repeat buyers is now 62, also a record high.

-

Almost 30% of repeat buyers paid all cash, compared to just 8% of first-timers.

-

Repeat buyers put down a median of 23%, while first-timers averaged 10% — the highest since 1989.

That mix of cash, equity, and experience makes it tough for new buyers to compete — especially in places like Naperville, where homes still sell close to asking price. In 2025, buyers typically paid 99% of the list price.

Why First-Time Buyers Are Getting Squeezed

There’s a perfect storm working against new buyers right now:

-

Higher mortgage rates: The average rate during the study period was 6.69%, keeping monthly payments higher than what we saw in 2020–2021.

-

Limited inventory: Most new listings are at higher price points, and true “starter homes” are harder to find.

-

Student loans and high rent: 59% of first-time buyers used personal savings to fund their down payment, and 26% pulled from 401(k)s or stocks. Saving while renting isn’t easy — and it’s taking people longer to get there.

Put all that together, and you can see why the typical first-time buyer in 2025 was 40 years old. It’s not because people don’t want to buy — it’s because it’s taking longer to be financially ready.

Why Repeat Buyers Are Winning the Bidding Wars

Why Repeat Buyers Are Winning the Bidding Wars

Homeowners who’ve been in the game awhile have built up serious equity over the past decade. Many have owned their homes for 10+ years and are using that equity to buy their next one — often with little or no financing.

They’re also more confident in the process. They’ve been through inspections, negotiations, and closing before, so they know how to move fast when the right home hits the market.

Here in Naperville and surrounding suburbs like Lisle, Downers Grove, Wheaton, and Aurora, we’re seeing this dynamic play out clearly: move-up buyers are driving most of the mid-range home activity, while first-timers are still trying to break through.

How to Get Ahead as a First-Time Buyer

If you’re a first-time buyer feeling discouraged, take a breath — this is absolutely doable with the right strategy and a good local plan. Here’s where to start:

1. Look Into Down Payment Assistance Programs

Illinois has several first-time homebuyer programs that can help with your upfront costs, including forgivable loans and grants.

2. Ask About Creative Financing

Some lenders offer 2-1 buydowns or temporary rate reductions that can make your early payments much more affordable.

3. Don’t Overlook New Construction

Builders in Naperville and nearby communities are offering rate buydowns, closing credits, or free upgrades to attract buyers. You can see current new construction options here.

4. Think Multi-Generational

Fourteen percent of buyers in 2025 purchased homes designed for multiple generations — saving money, combining resources, or caring for family under one roof.

5. Partner With the Right Realtor

Eighty-eight percent of buyers used an agent last year — and for good reason. The process is complicated, and having someone who knows how to find opportunities, write strong offers, and negotiate smartly makes all the difference.

That’s what I do. As a Naperville Realtor® with 20+ years of experience, I help buyers navigate this exact environment — from finding the right home to connecting with lenders who know how to structure creative financing.

Start here:

Download my Pathway to Qualification Program that focuses on educating First-Time Buyers.

The Bottom Line

Yes, today’s first-time buyers are older — but they’re also more prepared, financially stable, and strategic than ever. The path to homeownership may take longer now, but it’s still 100% within reach.

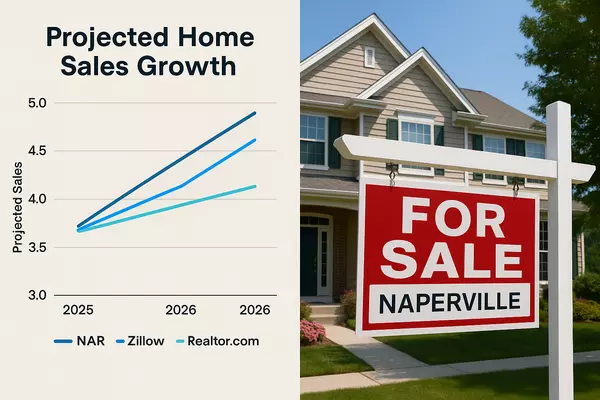

If you’re planning to buy your first home in 2025 or 2026, let’s talk early. I’ll walk you through local programs, financing options, and what it really takes to go from “someday” to sold.

📞 Call or text Joe Graham, Naperville Realtor® at 630-761-5415

📧 Email: joe@joegrahamhomes.com

Categories

- All Blogs (50)

- Community information (14)

- Dog Owners (2)

- Downsizing (11)

- First time home buyer (7)

- golf course homes (3)

- Home Buying Advice (14)

- Home Care and Maintenance (2)

- Living in (5)

- Luxury Condos (2)

- luxury homes (6)

- Naperville (24)

- Naperville Community (6)

- Naperville Festivals (2)

- Naperville Listings (15)

- New Construction (2)

- Summer Fun (2)

Recent Posts